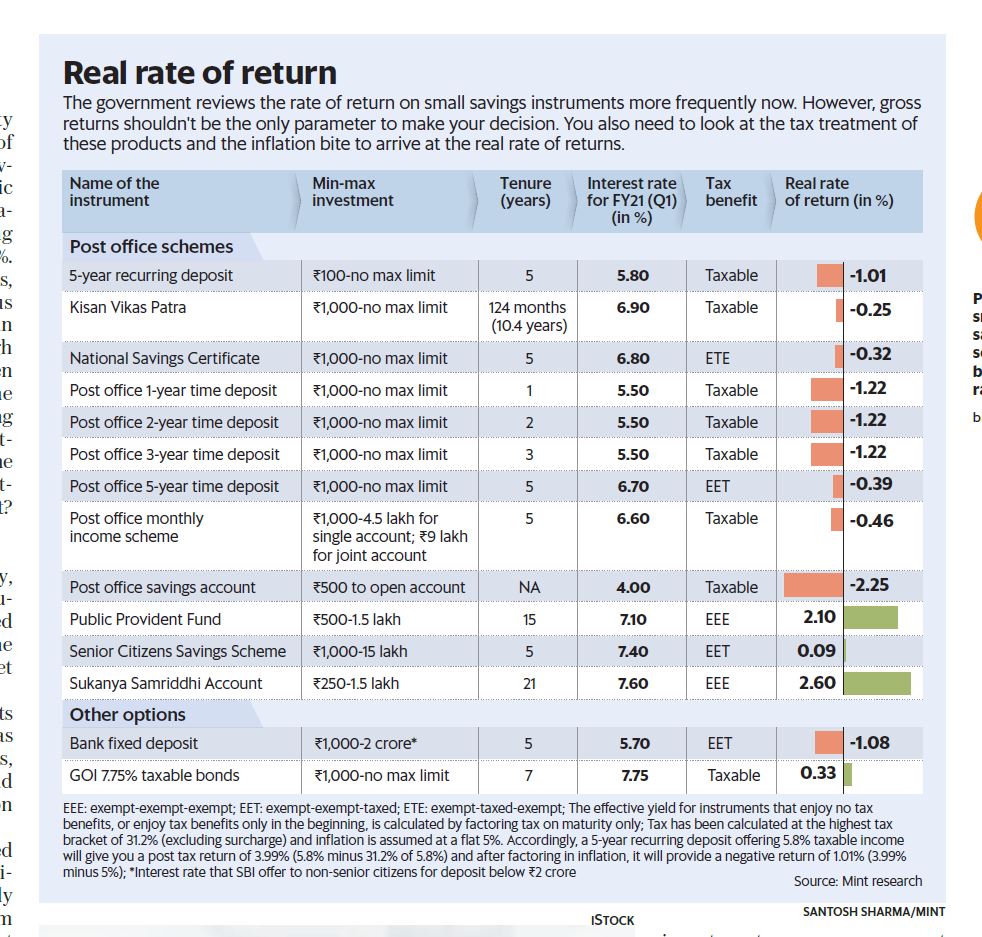

Investment is considered good if the returns is more than inflation. Investment should beat the inflation in long term and it would help to accumulate wealth.Mostly Indians favors and invest their money in fixed deposits,PF and insurance. It is knowledge transferred from their family and they continue to do the same. But is that really investment? Why that would not work now? Why everyone talks about investment now.

Investment creates wealth and beats inflation

Investment are intended to create wealth in long term. PF and fixed deposits worked earlier to create wealth. In year 2000, the interest rate for fixed deposit is 10% and interest rate for PF is 12%. It is much higher than inflation rate and it worked as investment. But the same logic would not work now.

Fixed deposit can be used to keep the emergency funds, but not as an investment

The fixed deposit maximum interest rate is 6.5% ( in SBI – senior citizens FD). Moreover 10% TDS would be taken out from interest earned on fixed deposit. After that it would become maximum 6%. The average inflation rate in India is 5%. Can you become rich by getting extra 1% on your investment using fixed deposit. PF provides 8.5% interest and it can be considered as investment in long term. It is one of the investment for retirement planning. Fixed deposit can be used to keep the emergency funds, but not as an investment.

FD returns 6% and inflation rate is 5%

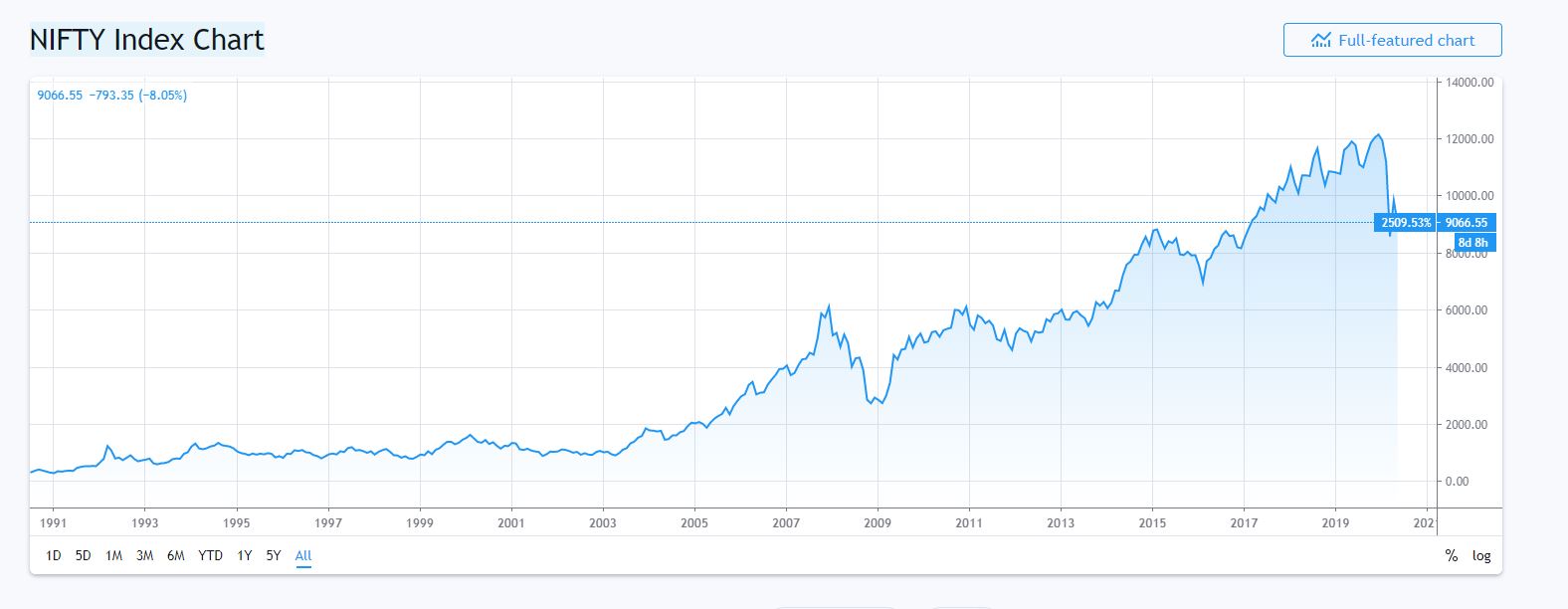

PF is better than FD in longer term. You can continue with PF as safe investment. Investments owning the assets. Gold, Real estate, Stocks and equity mutual funds are considered as assets. Here we own part of ownership in the asset and it grows along with inflation rates. Nifty index mutual funds provide 12% average return in long term. It crossed hard times in 2000, 2008 and 2016 in the market. But it gives better return in long term.

Investment in Nifty Index provide 12% in long term

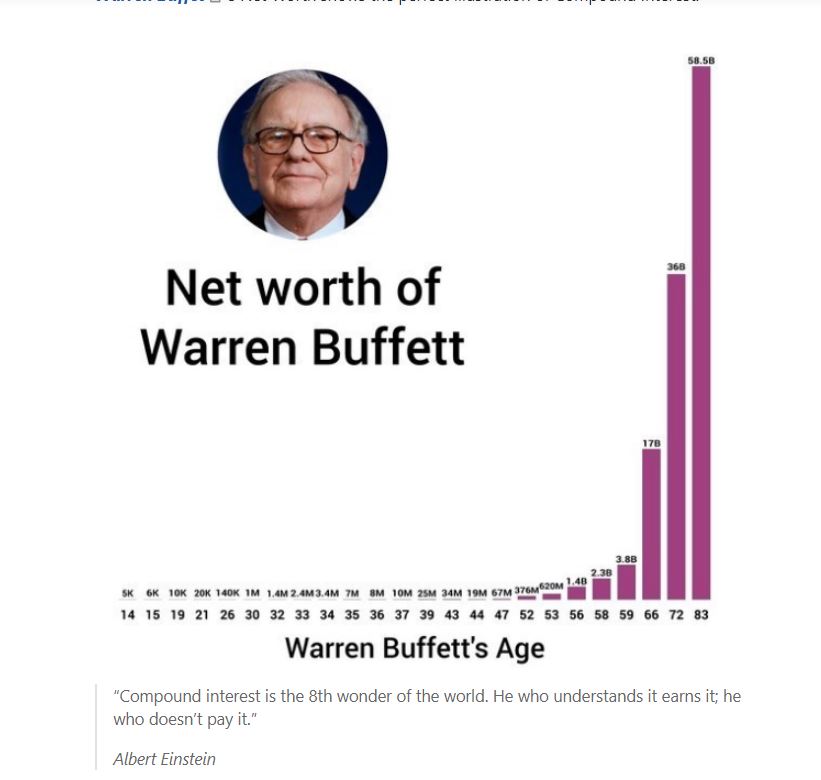

Usain Bolt won 8 gold medals in 3 Olympics, and he only ran for less than 115 seconds on the track, earning $119 million dollars. T But for those 2 minutes, he trained for 20 years. That’s investment. Think long term. Patience pays.”. Albert Einstein famously said that compound interest is the most powerful force in the universe. He said, “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Think long term. Patience pays in investment

Start the investment and let it grow by power of compounding. The longer you stay invested the more money you will make. The best way to take benefit of compounding is to start saving and investing wisely as early as possible. The earlier you start investing, the greater will be the power of compounding.

Investment options in India:

You can start by buying gold, investing in stocks and mutual funds, buy real estate at proper value. Real estate and stocks are good investment, but it requires time and lump-sum to start with. To invest in stocks, you have to spend time to understand the market dynamics. For real estate investment, it requires lump-sum money to buy an asset. Gold and equity mutual funds are easily accessible to everyone and it can be started with monthly 100 rupees.

Best way to invest your salary:

You can start with monthly 500 rupees in mutual funds SIP. You can start with nifty index funds or blue-chip mutual funds. Select anyone of nifty index funds or blue chip funds to create wealth.

- List down your financial goals.

- Login to anyone of mutual funds aggregators platforms PayTM money, Groww, Kuvera, Goalwise, PaiseBazaar, Zerodha, ETMoney

- Complete your KYC

Complete the KYC procedure with identity and address proof, cancelled cheque and photographs. - Choose funds for investment

UTI Nifty Index Growth Direct Plan

L&T Nifty 50 Index Growth Direct Plan

HDFC Index Nifty 50 Growth Direct Plan

ICICI Prudential Nifty Index Growth Direct Plan

SBI Nifty Index Growth Direct Plan

Axis Bluechip Growth Direct Plan

Mirae Asset Large Cap Growth Direct Plan

SBI Blue Chip Growth Direct Plan

5 Set Your SIP Details:

You can choose the SIP Amount which can be as low as Rs 100 a month and which date you want to invest in every month. Automatically the chosen money would be transferred from bank account to mutual funds on selected date.

You have to start your investment to beat the inflation and create wealth in long term. It is easy and simple. It can be started with monthly 500 rupees in mutual funds SIP. Start now.:)

LIC and EPF invests your money in Nifty Index. Are you investing?