PPF is very good instrument for long term retirement planning. But covid-19 second wave impacts everyone emotionally as well as financially. To support PPF account holder, government has allowed to withdraw three months basic from PPF. As the government has allowed its members to avail second non-refundable Covid-19 in advance. Covid 19 advance from PF step by step guide.

Withdraw from PPF only in case of emergency

All the members of PPF are eligible to withdraw PF advance. Even you withdrawn first advance last year, you are still eligible to withdraw once again due to second wave. It is to be noted that members who have already availed their first COVID-19 advance can now avail the option of utilizing the second advance.

HOW MUCH CAN YOU WITHDRAW?

All EPF account-holders can withdraw up to an amount which is lower of –

Three months’ salary ( Salary = basic pay + dearness allowance)

OR

75% of total EPF balance in your account

The second COVID-19 advance can be withdrawn online or offline mode. In this post, we have shown how to withdraw online.

Members who have already availed their first COVID-19 advance can now avail the option of utilizing the second advance.

Tax Relief :

The general income tax rules regarding the withdrawal of money from an EPF account state that funds withdrawn from an EPF account before the completion of 5 years of continuous service must be charged to tax in the year of the withdrawal.

However, in case you decide to withdraw funds from EPF account due to the COVID-19 pandemic, such withdrawal will be exempt from tax.

You can withdraw from both offline as well as online mode

How to withdraw offline:

To withdraw EPF through offline mode, one has to submit a physical application for its withdrawal. Steps for withdrawing EPF through offline mode are:

Step1: A PF account holder can download the new composite claim form (Aadhaar) or composite claim form (Non-Aadhaar) from the EPFO website. You can go directly to this link to download the form: https://www.epfindia.gov.in/site_en/index.php

Step 2: The members are required to fill new composite claim form (Aadhaar) and submit it to their respective EPFO office. The attestation of the employer is not needed.

Step 3: The same process has to be followed while filling new composite claim form (Non-Aadhaar). Here, the form has to be submitted after the attestation of the employer.

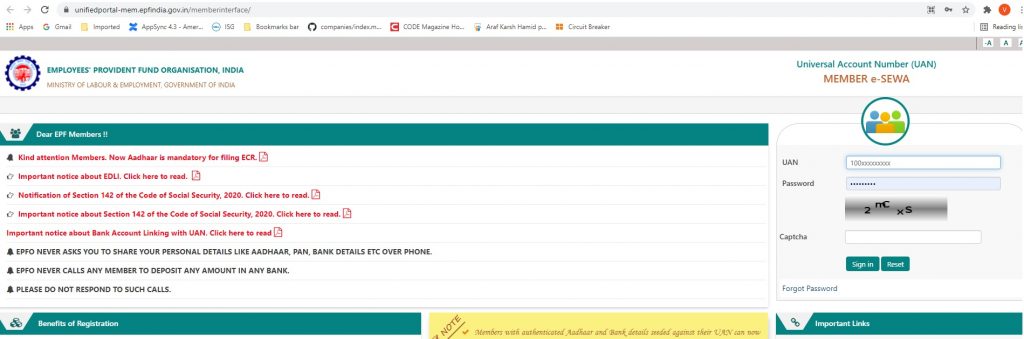

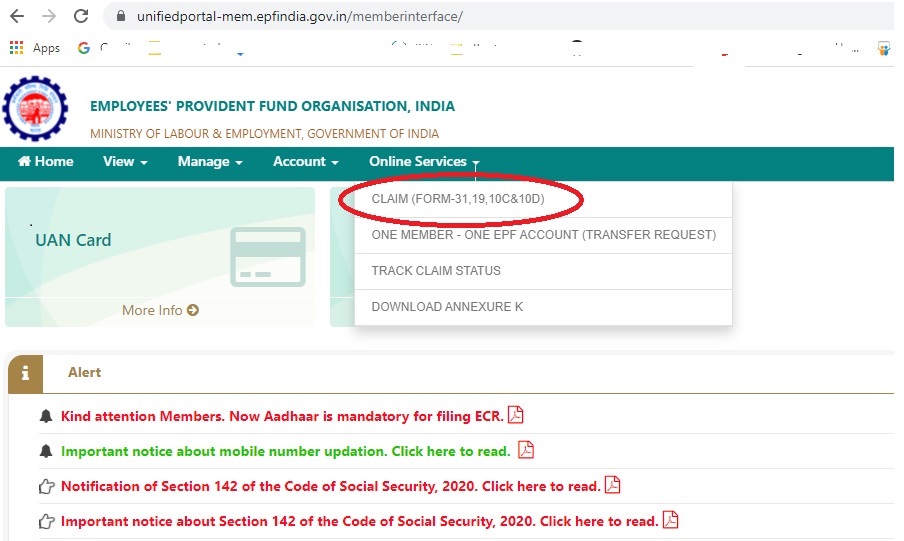

Steps for withdrawing the COVID advance(Online mode):

- Login to https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Goto “Online Services” menu

- Click “Cliams” submenu

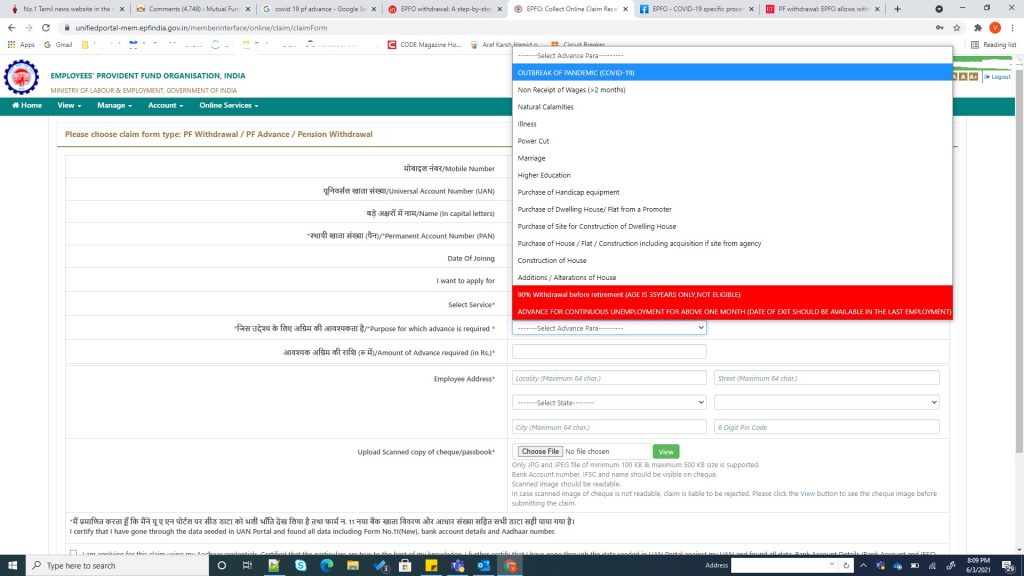

- Fill the bank details

- Select the “Outbreak of PANDEMIC” in the drop down

- Upload scanned copy of cheque book or passbook

- Get Aadhaar OTP and click submit

PF advance for covid-19 how many days:

Auto-mode of settlement enables EPFO to reduce the claim settlement cycle to just 3 days as against the statutory requirement to settle the claims within 20 days.